Company Timeline

1981

Company founded

HASI started in September 1981 as Eden Hannon Goodwin & Company, led by Greg Eden and Mike Hannon out of the firm’s first headquarters in Alexandria, Virginia. Eden Hannon was one of the first firms to utilize the “tax-exempt” lease to finance capital equipment upgrades for state and local governments.

The first closed transaction was a $300,000 Motorola communications system for the Petersburg, Virginia Police Department, and the company’s early financing focused on telecommunications, information technology and energy equipment vendors.

1983

Jon Armstrong joins the company and first federal transaction

Entrepreneur and former Naval aviator R. Jon Armstrong joined the firm and brought Federal contracting experience that was used to expand our client offerings. This year also was also marked by our first financing transaction with the U.S. Federal government, which involved telecommunications equipment for the FBI.

1985

Jeff Eckel joins the company

During his first stint with the company, 1985 to 1989, Jeff Eckel served as senior vice president and in the new energy project finance group. He didn’t close anything for the first two years and Mike Hannon was sure to remind him of it!

1987

First renewable energy transaction and first third-party financed energy efficiency asset for the U.S. government

Refinanced the Solar Energy Generating Systems III plant, a 30-megawatt concentrating solar plant in California to provide capital to develop SEGS VII and VIII. That same year, we pioneered the use of third-party capital for government energy efficiency projects with a 25-megawatt cogeneration plant at the Department of Energy facility.

1989

Firm renamed Hannon Armstrong and Eckel’s congressional testimony

The company renamed Hannon Armstrong after the departure of Greg Eden. This same year, Jeff Eckel testified to the U.S. Senate Energy Subcommittee on how to expand their energy performance contracting in the Federal government.

1991

Transition to merchant banking

While still financing IT and telecommunications assets for the U.S. government, Hannon Armstrong moved into the merchant banking business for U.S. federal contractors.

1995

Acquisition financing of Pathlore Software

Hannon Armstrong arranged the $20 million acquisition financing of Pathlore Software Corporation (business education software) from Computer Associates. Pathlore was later acquired by SumTotal Systems for $50 million.

1996

First energy performance contract financed

Hannon Armstrong financed its first of many energy service performance contracts (ESPCs) with $1 million ESPC for a lighting upgrade at the U.S. Postal Service building.

2000

Jeff Eckel returns as CEO, HannieMae Trust is launched

Jeff Eckel returned to Hannon Armstrong after leading Wärtsilä Power Development and EnergySource, with high-efficiency power systems and renewables in emerging markets, and the company’s headquarters were moved to Annapolis, Maryland. This same year, the company closed the Hannon Armstrong Multi-Asset Trust (a.k.a. “HannieMae”), the first securitization vehicle for financing Energy Savings Performance Contracts (ESPCs).

2003

Investment in undersea fiberoptic systems

The company provided $40 million for an undersea fiber-optic communication system from Svalbard, Norway, an island above the Arctic Circle, to a facility on the mainland of Norway. The fiber-optic network feeds weather and environmental data to the U.S. National Oceanic and Atmospheric Administration (NOAA), Department of Defense and NASA.

2006

HannieMae exceeds $1 billion of ESPC financings

The HannieMae securitization vehicle crossed the $1 billion mark with a combined 32 separate fundings, 191 transactions, 860 energy conservation measures for 14 energy service clients. The transactions were enough to offset the energy equivalent to .1% of all U.S. cars (129,000) on the road.

2007

Management buyout of Hannon Armstrong and 100% Employee Ownership Achieved

After Jon Armstrong’s untimely death in 2005, management recapitalized the firm with the private equity firm Mission Point Capital. Every employee became an owner of the new firm.

2008-2009

Clean energy financing during financial crisis

Despite the decline of the DJIA by 34% in 2008, the company still provided over $700 million of financing to clean energy assets in the 2008 and 2009 periods. Additionally, the firm developed the 49.9 MegaWatt Hudson Ranch geothermal project in California. The $400 million project was awarded the 2010 Project Finance Magazine’s 2010 North American Geothermal Deal of the year.

2013

Debut as a public company

Recognizing that climate change is a defining issue of our generation and that finance has much to contribute to the adoption of low carbon technologies, we became a public company – Hannon Armstrong Sustainable Infrastructure Capital – traded under the ticker “HASI” on the New York Stock Exchange on April 18, 2013. We believed then, as we do now, that the opportunity to finance the decarbonization of the economy is simply enormous, as industries like the 100-year-old+ electric utility sector evolve to more sustainable business models.

2013

First Sustainable Yield® Bond issuance

Hannon Armstrong sold $100 million of its first series of asset-backed Sustainable Yield Bonds™ (HASI SYBs). The transaction securitized the cash flows generated by over 100 individual wind, solar and energy efficiency installations, all with investment-grade obligors.

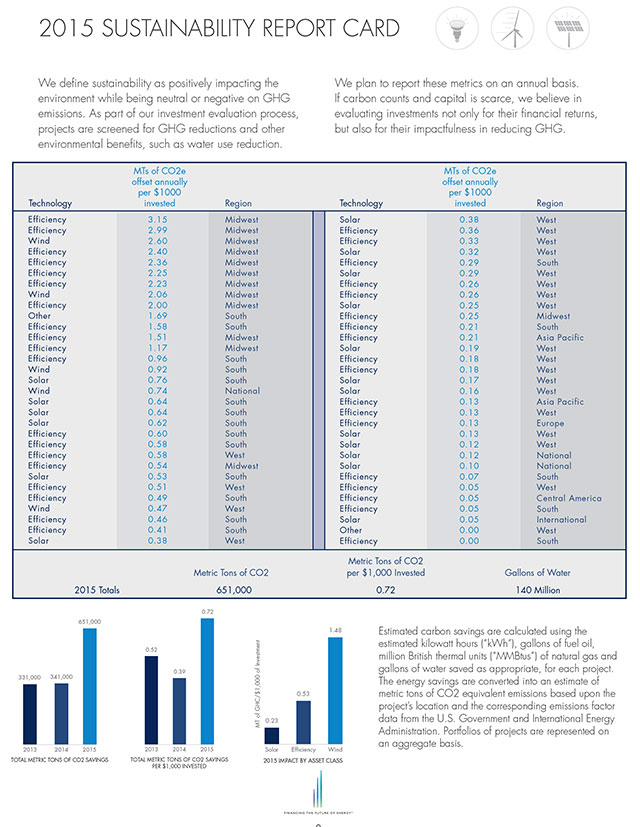

2015

CarbonCount® scoring tool launched

Working with the Alliance to Save Energy, Hannon Armstrong debuted CarbonCount®: a scoring tool that evaluates investments in U.S.-based, energy efficiency and renewable energy projects to determine how effectively they can be expected to reduce CO2 emissions per $1,000 of investment.

2015

First publicly rated asset-backed securitization

In September 2015, Hannon Armstrong completed an offering of A-rated (Kroll) Sustainable Yield Bonds issued secured by a portion of its utility scale solar and wind real estate. It was the winner of the First Green Bond Asset-backed Securitization by the Climate Bonds Initiative.

2019

Inaugural corporate debt rating

In June 2019, Hannon Armstrong received BB+ corporate long-term issuer credit ratings from S&P Global Ratings and Fitch Ratings. Fitch also rated the Company’s senior secured revolving recourse credit facility investment grade at BBB- and its unsecured convertible note BB+. Hannon Armstrong had previously received an investment-grade rating of BBB (low) for its long-term issuer rating and its senior secured revolving credit facility from DBRS.

2020

2020 was an exceptional year of growth and impact for the firm. Despite the pandemic, Hannon Armstrong posted record Distributable Earnings, transaction volumes, and carbon impact. In July, we announced a $553 million investment in a 2.3 GW portfolio of U.S. wind and solar projects operated by ENGIE. In December, we announced a $663 million investment in 1.6 GW wind, solar, and solar-plus-storage portfolio developed and managed by Clearway Energy Group.

2021

- Invested $1.7b in climate solutions

- 800k MT of incremental annual reductions in carbon emissions through our closed transactions

- Raised >$1.5b in CarbonCount-based debt

- Enhanced DEIJA through expanded public disclosures and reported a majority of new hires as women or people of color

- Declared Social Dividend of $1.6m to support Hannon Armstrong Foundation

2022

- Declared $1.85m social dividend to support Hannon Armstrong Foundation

- Invested in a 1.3 GW portfolio of 17 operating solar projects and one operating wind project owned and operated by AES, a Fortune 500 global energy company and one of the largest developers and operators of clean power in the U.S.

- Made first investment in RNG with a portfolio of operating Renewable Natural Gas Projects (RNG), including two Landfill Gas (LFG)-to-RNG plants and one Wastewater Treatment Biogas (WWTPB)-to-RNG plant

- Named to the global environmental non-profit CDP's 2022 'A List' for our climate positive leadership and exceptional environmental disclosure performance. HASI was one of 283 companies that achieved an 'A' – out of the more than 15,000 companies scored

2023

- Appointed Jeffrey Lipson to President and CEO of HASI and named Marc Pangburn Chief Financial Officer of HASI. Our previous CEO, Jeff Eckel, assumed the role of Executive Chair

- Adopted HASI as official company brand name and released a distinct, modernized logo for the company

- Held inaugural HASI Investor Day in Annapolis

- Launched CarbonCount® 2.0 methodology to give a more precise assessment of avoided emissions via newly available locational marginal emissions (LME) factors that reflect the grid composition specific to each project's location at the time of generation

- Celebrated the 10th anniversary of the HASI stock listing by ringing the bell at the New York Stock Exchange

2024

- Established a $2 billion strategic partnership with global investment firm KKR to invest in sustainable infrastructure projects

- Secured an investment grade rating of BBB- from Fitch Ratings, HASI’s second investment grade rating from a major credit rating agency